Having comprehensive The Importance of Health Coverage for Canadians is essential for Canadians. While Canada prides itself on universal healthcare, many services and treatments aren’t covered under the public system. From prescription medications to dental care, investing in the right health insurance plan ensures that these gaps are filled. If you’re wondering why health coverage matters, how it works, and what benefits it provides, this guide will help you make informed decisions about protecting your health and finances.

Table of Contents

Why Health Coverage Matters for Canadians

While the Canadian healthcare system provides excellent coverage for many essential services, it doesn’t cover everything. Here’s why health coverage is crucial for Canadians:

1. Gaps in Universal Coverage

The public healthcare system, while robust, often leaves out costs associated with:

- Prescription medications

- Dental procedures

- Vision care

- Physiotherapy

- Chiropractic services

These out-of-pocket expenses can quickly add up if you don’t have additional health insurance.

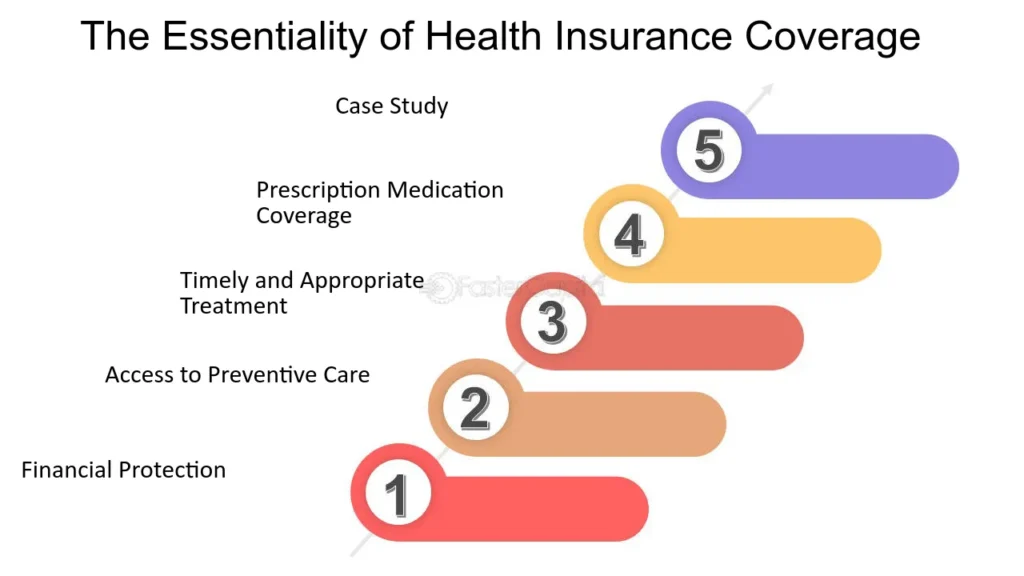

2. Financial Protection

Unexpected medical costs, such as emergency dental surgery or prolonged therapy sessions, can put a strain on your finances. Health coverage alleviates this burden by paying for services not included in the public system.

3. Access to Private Services

Private health insurance allows Canadians to access private healthcare facilities, reducing long wait times for diagnostics and specialized treatments that often occur in the public system.

4. Preventative Care Options

Health coverage encourages routine checkups, preventative treatments, and screenings, fostering a healthier lifestyle and reducing the risks of developing severe conditions.

What Are the Options for Health Coverage in Canada?

There are various ways Canadians can secure supplementary health insurance, depending on their needs and circumstances. Here’s a breakdown of the most popular options:

| Type of Coverage | Who It’s For | What It Covers |

|---|---|---|

| Employer-Sponsored Plans | Employees of companies offering group benefits | Dental, vision, and prescription drug coverage, and other extended health benefits |

| Individual Health Insurance | Self-employed people or those without employer coverage | Tailored coverage options such as dental, vision, and alternative therapies |

| Government Assistance Programs | Low-income individuals or seniors | Prescription medications, assistive devices, home care services |

| Family Plans | Households with multiple members | Comprehensive family-oriented coverage |

Key Benefits of Having Health Coverage

Still debating whether to invest in supplementary health insurance? Here are the primary benefits:

1. Peace of Mind

Health emergencies can happen when you least expect them. Knowing you’re financially prepared for unforeseen medical expenses provides invaluable peace of mind.

2. Improved Quality of Life

Health coverage gives you access to a wider range of treatments, including alternative therapies like physiotherapy and massage therapy, that improve both physical and mental well-being.

3. Savings on Essential Services

Prescription drugs, dental work, and eyeglasses are common expenses not covered by the public system. A private insurance plan ensures these costs don’t dip into your savings.

4. Tax Deduction Advantages

Some health insurance premiums can qualify as tax-deductible expenses, helping you save money during tax season.

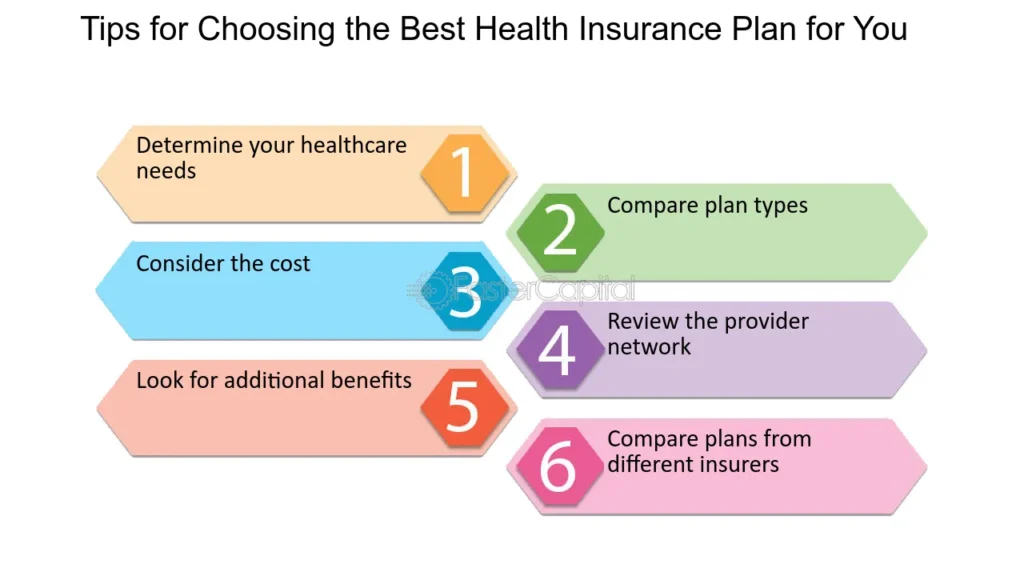

How to Choose the Right Health Insurance Plan

Not all health coverage plans are created equal. When shopping for a plan, consider the following:

1. Assess Your Needs

Think about your current health status and lifestyle. Are you someone with pre-existing conditions? Do you visit the dentist regularly? Tailor your coverage to align with your needs.

2. Compare Coverage Options

Look closely at the plans on offer. Does the plan cover the services you use most, such as prescription medications or vision care? Ensure it aligns with what’s most important to you.

3. Evaluate Premium Costs

Balancing coverage and cost is crucial. Find a plan with affordable premiums that still offers sufficient benefits, ensuring it doesn’t weigh heavily on your finances.

4. Check Network Providers

Some insurance companies have designated healthcare professionals or hospitals you must use under the plan. Ensure these providers are accessible to you geographically.

5. Read Reviews and Testimonials

Many Canadians rely on online reviews to evaluate how insurance companies handle claims. Don’t skip this step—it’s worth learning from other policyholders’ experiences.

FAQs About Health Coverage in Canada

1. Do I Really Need Health Insurance If Canada Has Universal Healthcare?

While universal healthcare covers many basic and emergency services, it doesn’t include things like dental care, prescription medication, or vision therapy. Private health insurance ensures you’re covered for such gaps.

2. What Factors Affect Health Insurance Premiums?

Age, pre-existing conditions, plan type, and your province of residence all play a role in determining the cost of your premiums.

3. Can I Customize My Health Insurance Plan?

Yes, many insurance providers offer customizable plans where you can add or remove certain benefits based on your needs.

4. Are Prescription Medications Covered Under Universal Healthcare?

Prescription medications are not generally covered by public healthcare except under specific circumstances, such as for seniors or those with government assistance.

5. Can I Switch Health Insurance Providers?

Yes, though you should carefully review the terms of your current policy and the waiting periods set by new providers before switching.

Taking the Next Step Towards Comprehensive Health Coverage

Staying healthy is priceless, but healthcare often comes with a cost. Investing in health insurance ensures not only that your medical needs are met, but also your financial stability.

Take control of your health today. Start by assessing your coverage options and considering your unique needs. Whether it’s through employer-sponsored plans or individual health insurance, there’s always a way to protect yourself and your loved ones. Think of it as an investment in a healthier, more secure future.